Signs of a Slowing Economy and Easing Inflation

Market Recap for the Week of December 15, 2025

Last week, a wave of delayed economic data finally hit the market due to the recent government shutdown. Two reports stood out in particular. First, the unemployment rate ticked up from 4.5% to 4.6% in November, reinforcing the narrative that the labor market is gradually slowing. While 4.6% is still relatively low, the upward trend is noteworthy—it’s a meaningful increase from the 3.4% low seen in April 2023.

Inflation data for November also came in, showing an annual rate of 2.7%. This marks a welcome drop, bringing year-over-year inflation below 3%. If inflation continues to ease while the labor market softens, the Federal Reserve may feel increased pressure to cut rates. However, according to the CME FedWatch Tool, the odds of a rate cut at the January meeting remain relatively low, at just 22%. It’s also worth noting that the government shutdown likely caused distortions in October and November’s inflation measurements, so this reading may slightly overstate the decline.

“A cooling labor market and easing inflation are putting rate cuts back on the radar—just not yet.”

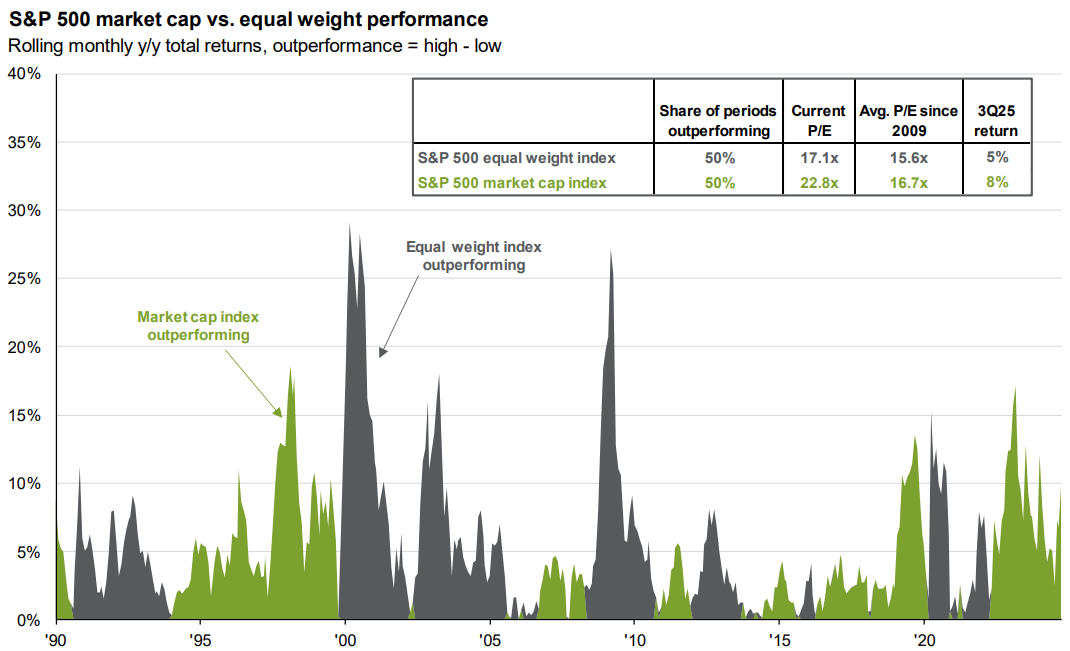

Chart of The Week

Investors have two main ways to approach equity index investing. The most common is a market-cap-weighted index, which allocates more money to the largest stocks. The alternative, equal weighting, invests the same dollar amount in every stock in the index. As this week’s chart shows, both strategies have had periods of outperformance. Interestingly, market-cap weighting outperforms about 50% of the time, with equal weighting taking the other 50%. A common pitfall is chasing whichever strategy has recently led the market, only to see the leadership reverse.

The commentary in this blog is for informational purposes only and should not be taken as personalized investment advice

Sources: FactSet, J.P. Morgan Asset Management. Past performance is no guarantee of future results. Guide to the Markets – U.S. Data are as of September 30, 2025.