Three in a Row? What a 20% Market Year Would Mean Now

Market Recap for the Week of December 1, 2025

The odds of a 20% year in stocks are starting to look realistic, with the S&P 500 up 18.15% on a total-return basis. If the index reaches 20% by year-end, it would mark the third consecutive year of 20%-plus gains. For context, the S&P 500 returned 24.93% in 2024 and 26.32% in 2022. The last time we saw three straight years of such strong performance was during the late 1990s—though that period actually delivered five consecutive years of 20%+ gains from 1995 through 1999. The three years that followed were negative.

Many investors look to the past to identify patterns they hope will repeat. The prevailing narrative is that we’re in an AI-driven bubble reminiscent of the late ’90s, and that a similar outcome is inevitable. But history rarely repeats itself verbatim. And if this period is comparable to the late 1990s, then history would also suggest we could still have a few years of “face-melting” returns ahead. Turning bearish too early could prove to be a mistake.

Investors should balance their bullish and bearish impulses. Every market environment offers reasons for optimism as well as reasons for caution. Leaning too far in either direction can lead to poor decisions. All eyes will be on the Federal Reserve next Wednesday, with futures markets currently pricing in an 86% probability of an interest-rate cut.

“The prevailing narrative is that we’re in an AI-driven bubble reminiscent of the late ’90s, and that a similar outcome is inevitable. But history rarely repeats itself verbatim.”

Chart of The Week

This week’s chart, sourced from Apollo Asset Management, highlights the historical relationship between Nasdaq prices—a tech-heavy index—and Bitcoin. The two have often moved in tandem, but recent market action shows a notable divergence. The takeaway: correlations can shift. Just because two assets have moved together in the past does not guarantee they will continue to do so in the future.

The commentary in this blog is for informational purposes only and should not be taken as personalized investment advice

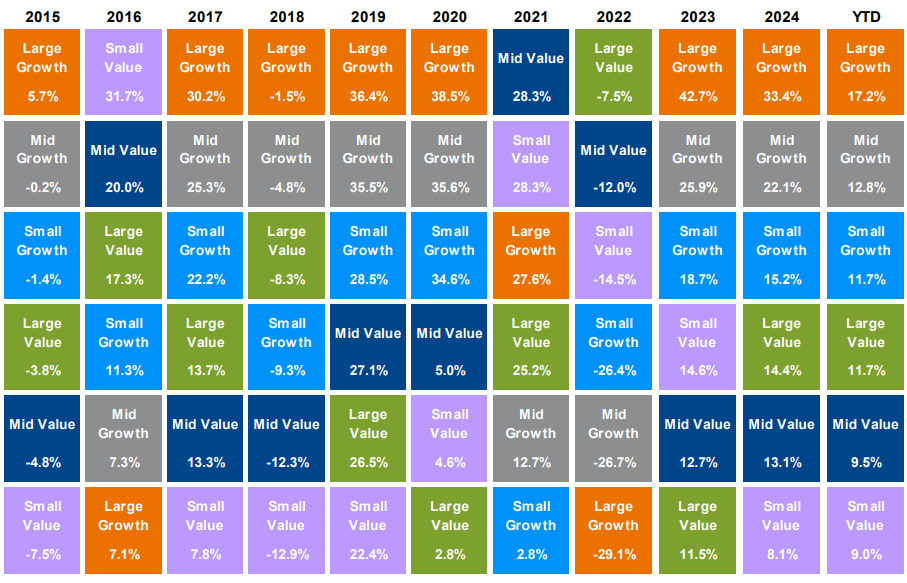

Sources: FactSet, Russell Investment Group, J.P. Morgan Asset Management.