Fed Cuts Rates Again

Market Recap for the Week of November 2, 2025

The Federal Reserve cut interest rates by another 25 basis points on Wednesday. The move itself came as no surprise—futures markets had priced in a 99% probability of this outcome. What did catch investors’ attention, however, was Jerome Powell’s tone during the post-meeting press conference. He indicated that a rate cut in December may not be on the table.

Of the voting members on the Federal Open Market Committee (FOMC), two dissented—one favored a larger cut, while another opposed any cut at all. Following the press conference, U.S. equities drifted lower for the remainder of the week, though the decline was modest—less than 1%.

If the government does not reopen in the coming days, this will become the longest government shutdown on record. The longer it continues, the greater the risk of economic fallout. If the shutdown persists into next week, the U.S. will miss another employment report (originally scheduled for November 7th), further clouding our view of the labor market.

While official data remain limited, anecdotal signs of slowing are emerging—most notably Amazon’s recent announcement of 14,000 job cuts.

“With data limited and layoffs rising, anecdotal signs of slowing are hard to ignore.”

Chart of The Week

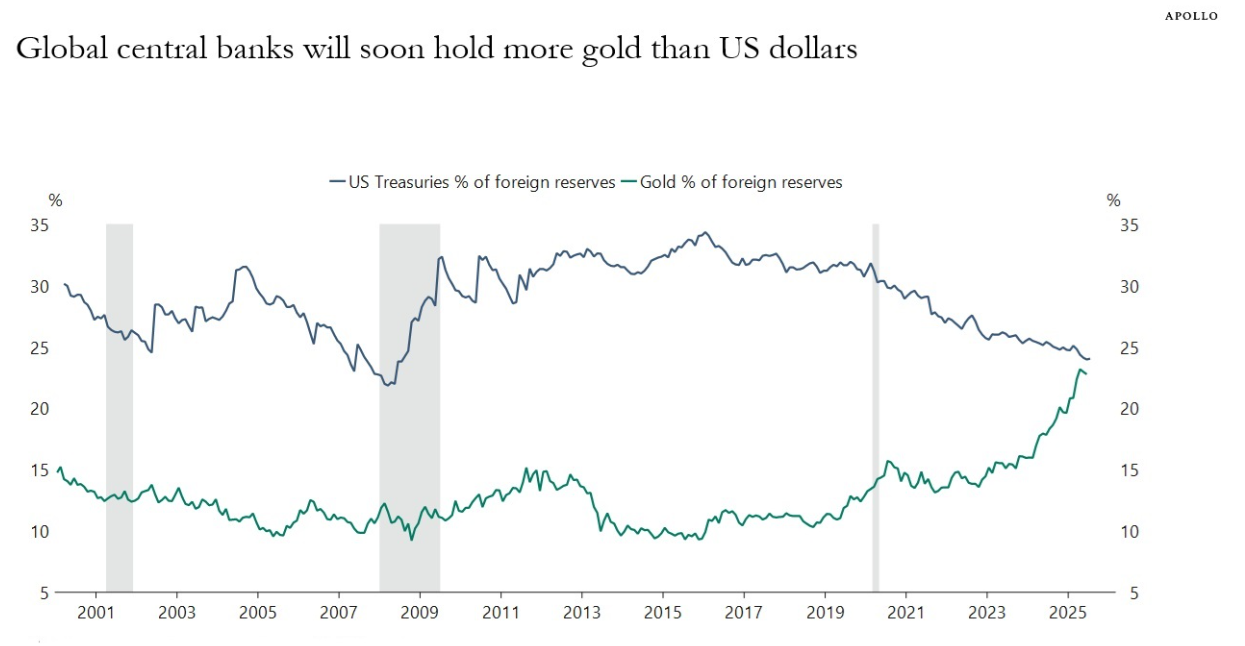

Gold has drawn considerable attention this year, posting its strongest annual performance in over a decade. A key driver behind this rally has been increased demand from central banks.

As illustrated in the chart, the green line represents the share of global central bank reserves held in gold. That share has climbed sharply, while holdings of U.S. Treasuries have declined. In short, central banks worldwide are shifting allocations away from Treasuries and toward gold.

The commentary in this blog is for informational purposes only and should not be taken as personalized investment advice

Sources: International Monetary Fund (IMF), Macrobond, Apollo Chief Economist