A Pause for Gold, a Lift for Stocks

Market Recap for the Week of October 26, 2025

Despite the ongoing government shutdown, we actually got new inflation data (CPI) for September. The Bureau of Labor Statistics (BLS) has been affected by the shutdown, but they’re legally required to release inflation numbers so the Social Security Administration can calculate next year’s cost-of-living adjustment (COLA).

Inflation rose 0.3% in September. The biggest driver was gasoline prices, which jumped 4.1% for the month. However, gas prices are notoriously volatile — and over the past 12 months, they’re actually slightly lower overall.

Because the report was viewed as relatively positive, U.S. stocks had a solid week. The S&P 500 gained 1.48%, while small-cap stocks did even better, rising 2.18%. Gold, after a historic run, finally cooled off, slipping 5% for the week.

Meanwhile, the 10-year Treasury yield fell below 4%, showing that demand for bonds remains strong. Remember — when bond yields go down, prices go up, meaning there are more buyers than sellers.

“Even amid a government shutdown, markets showed confidence — stocks rose, bond demand stayed strong, and inflation remained in check.”

Chart of The Week

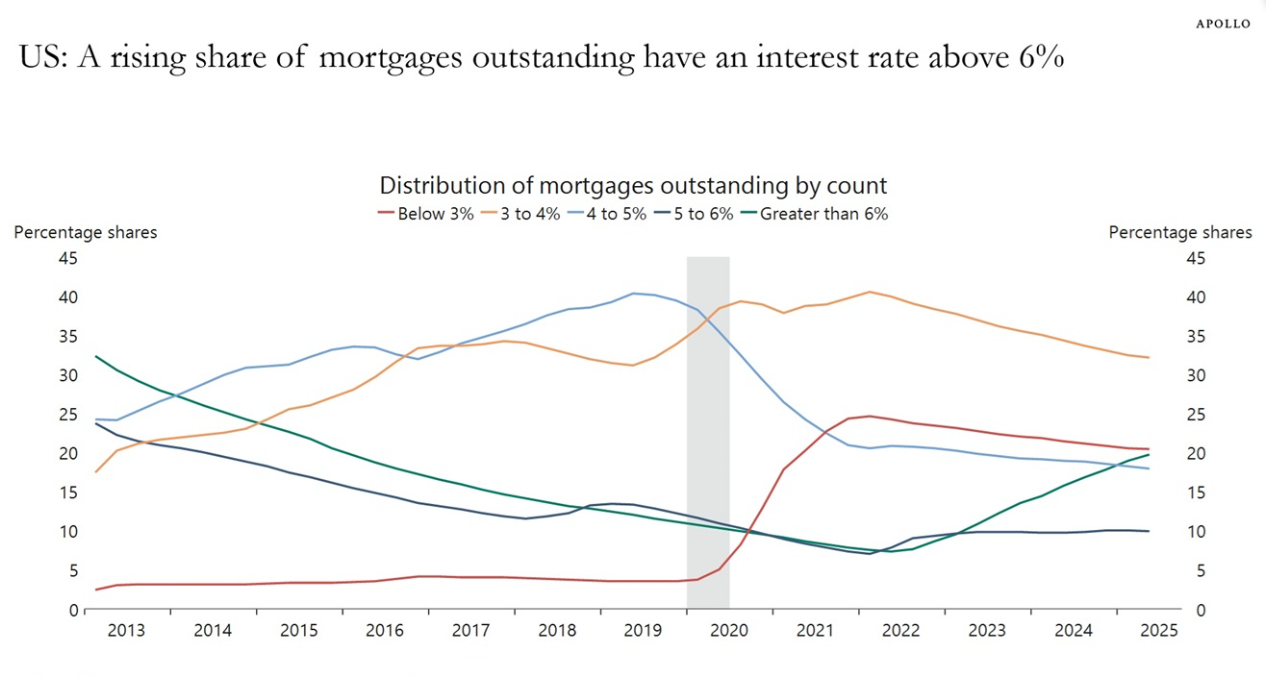

This week’s chart comes from Apollo Asset Management and shows the distribution of outstanding mortgages.

The green line represents mortgages with rates above 6% — and that number has been climbing since 2022. Higher mortgage rates leave households with less disposable income, especially compared to those who locked in 3% loans a few years ago.

Bottom line: As more mortgages move above 6%, consumers will have less room to spend, which could slow other parts of the economy.

The commentary in this blog is for informational purposes only and should not be taken as personalized investment advice

Source: Federal Housing Finance Agency (FHFA), Macrobond, Apollo Chief Economist