Shutdown Ends, Markets Shrug

Market Recap for the Week of November 10, 2025

After a record-breaking 43-day standoff, Washington has finally reopened for business. The Senate passed a funding bill earlier this week, and President Trump signed it Wednesday night—officially ending the longest government shutdown in U.S. history.

But while the lights are back on, the government isn’t fully back up to speed. Key economic reports—such as Friday’s scheduled jobs data from the Bureau of Labor Statistics—are delayed. Two days of operations simply isn’t enough time to reboot the data pipeline. Investors and policymakers alike will be watching closely to see whether the Federal Reserve receives enough economic data ahead of its next rate decision, now just three weeks away.

Despite the political breakthrough, markets barely flinched. The S&P 500 fell just under 1% on the week. Mega-cap growth stocks continued their recent pullback:

Nvidia: –2.53%

Tesla: –8.00%

Palantir: –5.48%

Oracle: –9.43%

While weakness in the names that led the rally may feel uncomfortable, it’s also healthy. A durable market needs broader participation—not just a handful of tech giants doing all the work.

“Even after the shutdown ended, markets barely flinched—proof that a durable rally needs more than a few tech giants.”

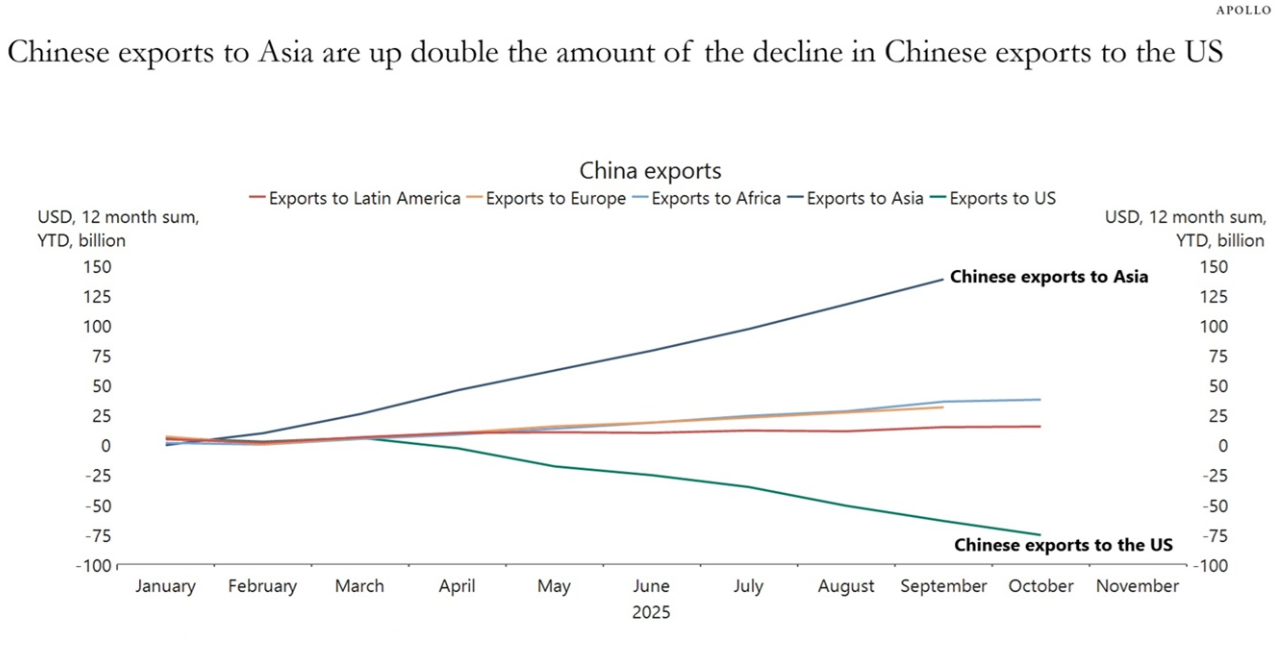

Chart of The Week

This week we highlight a chart from Apollo Asset Management showing one of the most significant long-term effects of the Trump-era tariffs: a sharp decline in U.S.–China trade.

The green line tracks the 12-month change in Chinese exports to the United States—and the trend is decisively downward.

The dark blue line shows Chinese exports to the broader Asian region, which have risen sharply.

The takeaway: China is exporting less to the U.S., but not necessarily exporting less overall. Trade is realigning, not disappearing.

The commentary in this blog is for informational purposes only and should not be taken as personalized investment advice

Sources: China General Administration of Customs (GAC), Macrobond, Apollo Chief Economist