Markets Broaden as International Stocks and Gold Take the Lead

Market Recap for the Week of January 19, 2026

Last week brought a modest pause in the dominance of small-cap stocks. While both small- and mid-cap equities have delivered strong year-to-date performance, Friday saw meaningful pullbacks in both segments. In contrast, international stocks—across both developed and emerging markets—were the best-performing areas of the market for the week.

The performance gap between international and U.S. equities continues to widen in 2026. Emerging market stocks are now up 6.9% more than U.S. stocks year-to-date, following a strong 2025 in which emerging markets outperformed the U.S. by roughly 16%. Still, longer-term context remains important: over the trailing 10 years, U.S. equities have outperformed emerging markets by nearly 6% annually. In other words, despite recent strength, emerging markets are still climbing out of a substantial long-term performance hole.

Gold has also been a standout early in the year, gaining 15.55% so far in 2026 after posting an extraordinary nearly 64% return in 2025. While recent performance has been impressive, gold remains a highly volatile asset class. History offers a useful reminder: from 1980 through the mid-2000s, gold delivered negative returns for more than 25 years. Investors often gravitate toward gold during periods of heightened geopolitical or economic uncertainty—and that uncertainty appears to be rising.

“Gold’s impressive gains come with a reminder: past cycles included more than 25 years of negative returns.”

Chart of The Week

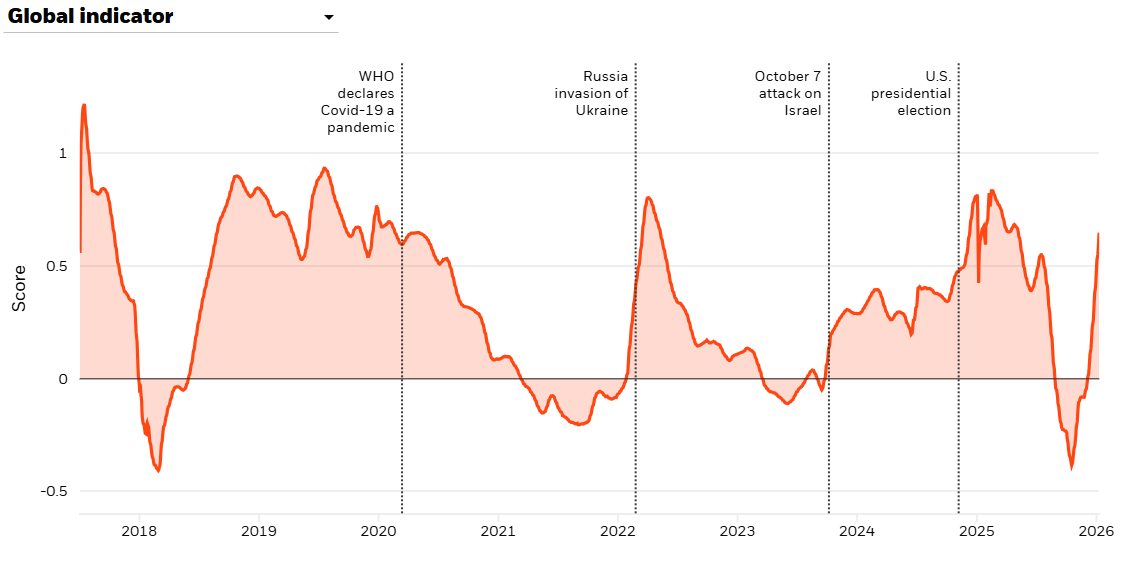

BlackRock publishes a Geopolitical Risk Indicator designed to capture shifts in investor concern around major global events. While no single index should be taken as definitive, it can provide a useful snapshot of prevailing sentiment. The indicator is constructed by analyzing the frequency of financial news coverage related to issues such as Middle East conflict, global trade tensions, and political risk in emerging markets.

The takeaway is straightforward: geopolitical risk readings have risen sharply at the start of the year. With headlines dominated by uncertainty, it’s not surprising that some investors feel uneasy. As always, maintaining perspective and focusing on long-term fundamentals remains critical during periods of heightened noise.

The commentary in this blog is for informational purposes only and should not be taken as personalized investment advice

Sources: FORWARD-LOOKING ESTIMATES MAY NOT COME TO PASS. BlackRock Investment Institute, January 2026. Notes: The BlackRock Geopolitical Risk Indicator (BGRI) tracks the relative frequency of brokerage reports (via Refinitiv) and financial news stories (Dow Jones News) associated with specific geopolitical risks. We adjust for whether the sentiment in the text of articles is positive or negative, and then assign a score. This score reflects the level of market attention to each risk versus a five-year history. We assign a heavier weight to brokerage reports than other media sources since we want to measure market attention to any particular risk, not public. As part of the December 2024 update, we removed the Climate policy gridlock risk to introduce a new risk, Global trade protectionism.