Economic Data Conflicts, Yet Equities Maintain Momentum

Market Recap for the Week of September 14, 2025

It was a mixed week for economic data but ultimately a positive one for U.S. equities, with the S&P 500 gaining a little over 1%.

Producer Prices: On Wednesday, the Producer Price Index (PPI) showed a 0.1% decline in August, signaling easing cost pressures for businesses.

Consumer Prices: Thursday’s Consumer Price Index (CPI) report told a different story, with consumer prices rising 0.4% in August.

Consumer Sentiment: Friday’s University of Michigan Survey of Consumers fell nearly 5% from the prior month and is down about 20% year-over-year. Respondents cited worries about a softening labor market and the impact of tariffs.

Despite the weaker sentiment, the bull market remains intact, and the S&P 500 is still up more than 10% year-to-date.

“Despite mixed economic data and declining consumer sentiment, the S&P 500 remains up over 10% YTD.”

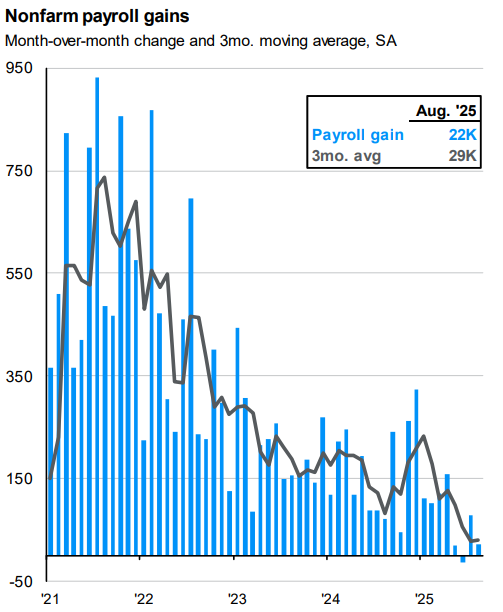

Chart of The Week

This week’s chart, drawn from the J.P. Morgan Guide to the Markets, highlights the cooling labor market. The blue bars track net monthly job gains, which have been trending lower and are now approaching negative territory. This aligns with the decline in consumer sentiment released Friday.

The commentary in this blog is for informational purposes only and should not be taken as personalized investment advice

Source: BLS, FactSet, J.P. Morgan Asset Management. Guide to the Markets – U.S. Data are as of September 11, 2025.