Markets Stumble as Trade Tensions Heat Up

Market Recap for the Week of October 12, 2025

The U.S. stock market was steady from Monday through Thursday, but a sharp drop on Friday left the S&P 500 down about 2.75% for the week. The selloff followed comments from President Trump, who threatened additional tariffs on China. These proposed tariffs are in response to China’s new export controls on rare earth minerals — materials that are crucial for producing semiconductors.

Chinese stocks, as measured by the iShares MSCI China ETF, fell nearly 6% on Friday, while semiconductor stocks, tracked by the iShares Semiconductor ETF, were down more than 6%.

In other news, the federal government shutdown continues. As of Friday, significant layoffs have begun, which could further strain an already weakening labor market. Unfortunately, because of the shutdown, the Bureau of Labor Statistics is unable to release its monthly jobs report, leaving investors with less clarity on the true state of employment.

The U.S. dollar index also slid on Friday, bringing its year-to-date decline to about 8.8%. The weaker dollar has provided a lift to international stocks and gold, which often move in the opposite direction of the dollar.

Gold has been a standout performer this year, up roughly 50% year-to-date. However, it’s worth remembering that gold delivered a 0% return from its 2011 peak through August 2023. While gold can shine in certain environments, it can also go decades without making much progress. If the dollar continues to weaken, that could support gold prices — but it would also benefit international equities. Unlike gold, international stocks generate cash flow, so in our view, there’s a stronger long-term case for owning non-U.S. stocks than gold.

“Short-term swings in stocks and commodities remind us that diversification — across assets and geographies — remains essential.”

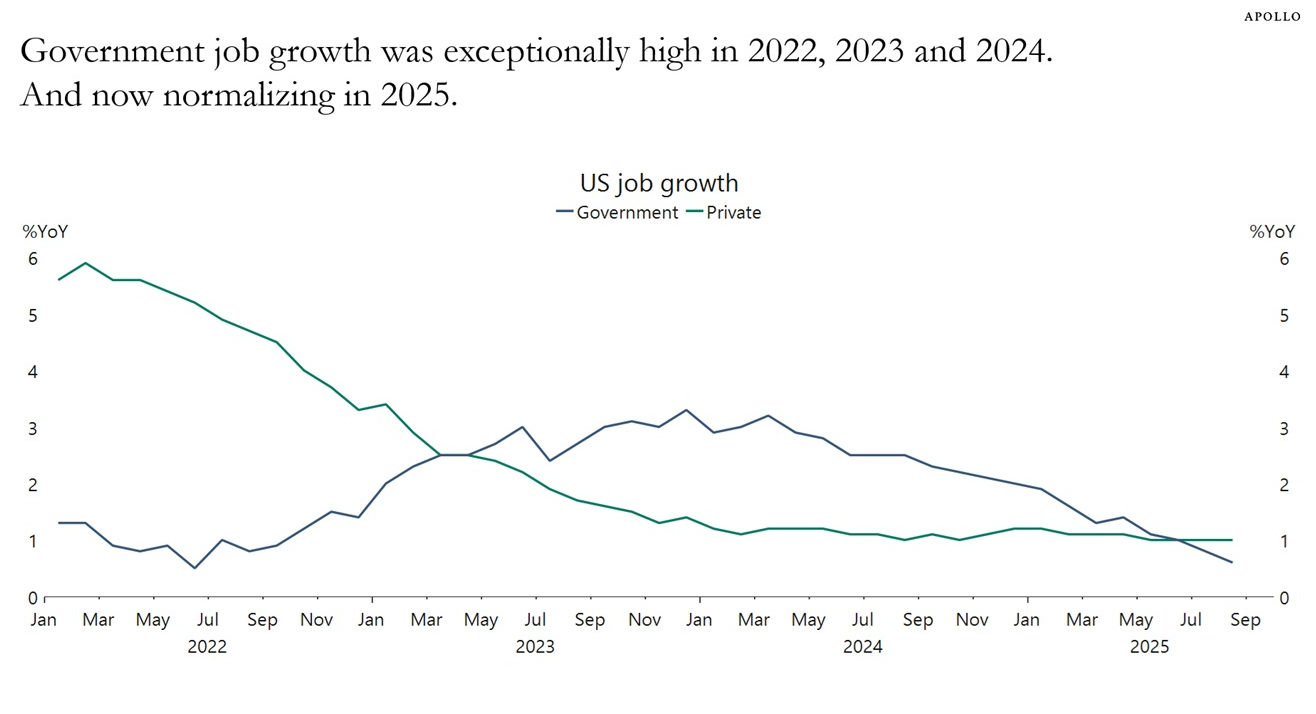

Chart of The Week

This week’s chart shows job growth in both the private and government sectors. The green line represents private jobs, while the blue line shows government employment. Over the past few years, private sector job growth has remained flat, while government jobs grew at a faster pace. Recently, that growth has slowed, with government employment dipping below 1% year-over-year. This normalization in public sector hiring is one of the key reasons behind the current softness in the labor market.

The commentary in this blog is for informational purposes only and should not be taken as personalized investment advice

Sources: US Bureau of Labor Statistics (BLS), Macrobond, Apollo Chief Economist